News

Enameled Wire Industry Witnesses Structural Growth in 2025: High-End & Green Transition as Core Drivers

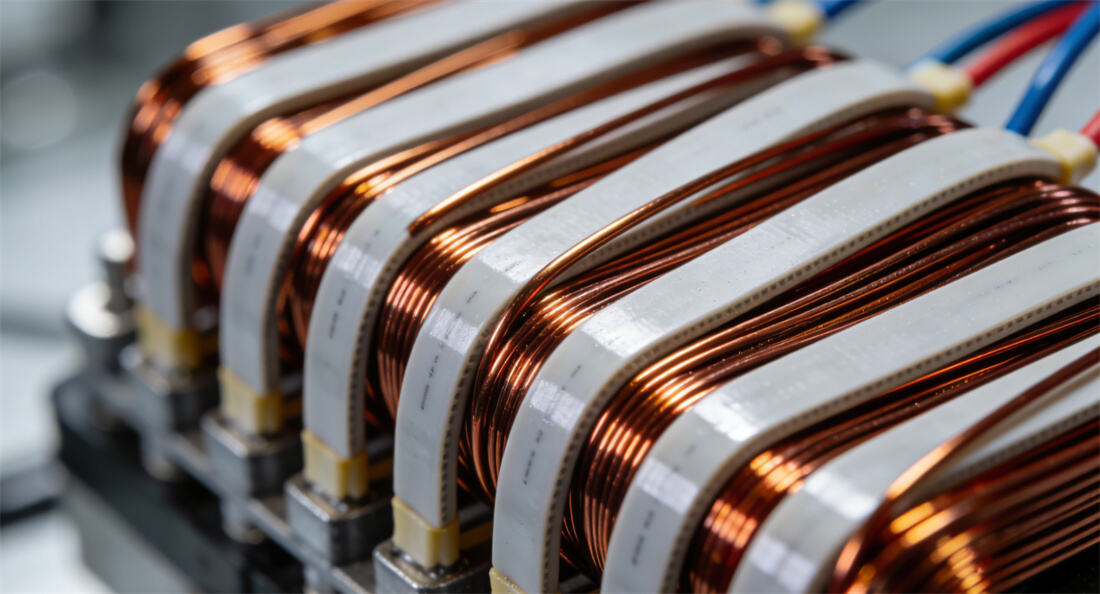

As a core industry in the electrical materials sector, China's enameled wire industry has maintained sustained growth alongside structural optimization in 2025. Latest industry data shows the annual market size reached 49.5 billion yuan with output exceeding 2 million tons, a year-on-year increase of 5.8%. The proportion of high-performance products has risen significantly, with downstream sectors such as new energy vehicles (NEVs) and high-efficiency energy-saving motors emerging as core growth engines.

Steady Market Expansion & Accelerated Product Structure Upgrade

In 2025, the enameled wire industry moved beyond scale-driven growth into a critical phase of quality and efficiency transformation. Data indicates that high-performance enameled wire (high-temperature resistant, high-conductivity, and environmentally friendly) accounts for over 35% of the market, while Class F and above heat-resistant products represent 42.3% of output—an increase of nearly 15 percentage points from 2020.Notably, flat enameled wire for NEVs has demonstrated exceptional performance. Driven by the 68% penetration rate of flat wire motors, this niche market grew by 31.7% year-on-year, with demand for corona-resistant and high-flexibility products increasing at an average annual rate of over 20%.Regionally, the Yangtze River Delta remains the core industrial cluster, with Jiangsu and Zhejiang provinces contributing 52% of national output. Guangdong accounts for 14.6% leveraging its electronic information industry advantages, while Jiangxi has emerged as a new growth pole with a 19.4% output growth rate supported by copper resource endowments.Market concentration continues to rise, with the top 10 enterprises including JINGDA, CITYCHAMP DARTONG ADVANCED MATERIALS CO., LTD., and ROSHOW controlling over 60% of total capacity. Leading companies have established competitive barriers through technological accumulation and economies of scale, while small and medium-sized enterprises face dual pressures from costs and environmental regulations.

In-depth Adjustment of Supply-Demand Structure: Driven by Both Costs and Demand

At the industrial chain level, high volatility in upstream copper prices has become a major cost pressure. The average price of Shanghai Copper Futures rose by 12% year-on-year in 2025, forcing enterprises to control costs through hedging, long-term contract procurement, and R&D of copper-aluminum composite conductors.Leading enterprises such as JINTIAN have limited cost increases to within 5% through vertical integration, while small and medium-sized enterprises face significant gross profit margin pressure due to weak bargaining power.

Demand has shown structural differentiation, with NEVs, high-efficiency energy-saving motors, and 5G communication equipment collectively contributing over 60% of new demand.Among these, NEVs drove approximately 338,000 tons of new enameled wire demand, accounting for 27.4% of total consumption. High-efficiency energy-saving motors saw a 9.4% year-on-year demand increase driven by energy efficiency improvement initiatives.The export market performed impressively: cumulative exports of copper enameled wire reached 117,900 tons from January to October, a year-on-year increase of 23.46%. India and Turkey emerged as standout markets with growth rates of 768.5% and 198.8% respectively.

Policy & Technology Dual Drivers: Accelerated Green Transition

Policy-wise, the "dual carbon" strategy and stricter environmental standards have promoted industrial transformation. Following the implementation of the Cleaner Production Evaluation Index System for the Wire and Cable Industry, enterprises are required to maintain comprehensive energy consumption per unit product below 0.38 tons of standard coal/ton and VOCs emission concentration below 50mg/m³.Annual environmental technology upgrading investment reached 2.86 billion yuan, a year-on-year increase of 23.4%. The state has included high-temperature resistant composite-coated copper-clad aluminum wire in the Catalogue of Key Supported New Materials, reducing enterprises' average R&D costs by 18.3%.Technological innovation has become a core competitiveness: leading enterprises maintain R&D investment intensity above 4%, with JINGDA focusing on corona-resistant enameled wire for 800V high-voltage platforms and ROSHOW specializing in wire rod R&D for silicon carbide (SiC) motors.Solvent-free coating processes and digital factory construction are accelerating, with the industry's solvent-free rate reaching 35%. Digital transformation has reduced energy consumption by 23%.New technologies such as graphene coatings and nano-modified insulating paints have achieved industrial application, driving product evolution toward Class 240+ high heat resistance and low dielectric loss.