News

The surge in demand for new energy driven enameled wire industry welcomes structural upgrading and globalization opportunities

As a core material for electrification, the enameled wire industry is entering a critical period of demand restructuring and technological iteration. Benefiting from the explosive growth in emerging fields such as new energy vehicles and industrial automation, the Chinese enameled wire market in 2024 presents a distinct feature of "high-end product shortage and export expansion against the trend", while facing dual challenges of capacity optimization and technological breakthroughs.

1. Demand side: New energy becomes the first growth engine, and the gap in high-end products is expanding

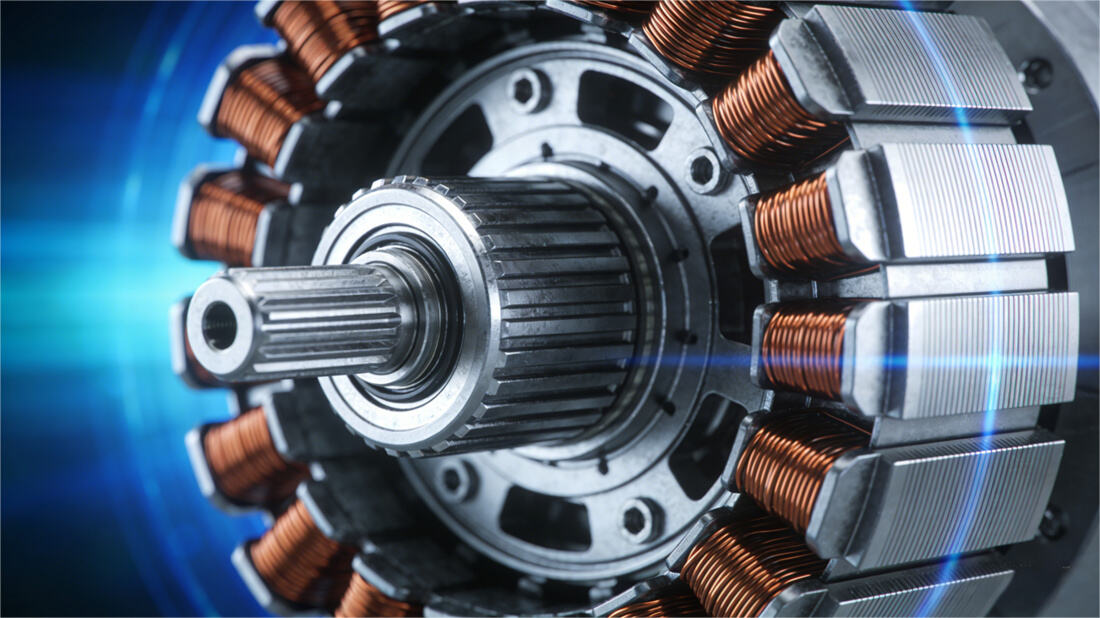

The explosive growth of the new energy vehicle industry has become the core driving force of the industry. Data shows that in 2024, the demand for enameled wire in the new energy vehicle field will account for more than 30% of the industry's total demand, with a year-on-year growth of over 40%. The promotion of 800V high-voltage platform models will drive a compound annual growth rate of 18% in the demand for high-temperature resistant enameled wire. The demand for high-temperature resistant, corona resistant, and low dielectric loss special enameled wires from car companies such as BYD, SAIC, and GAC directly drives the expansion of the high-end product market. The demand for industrial automation and smart grid is increasing synchronously. The demand for special enameled wire for industrial robots will increase by 35% year-on-year in 2024, and the requirement for high-strength and high-frequency adaptable materials for servo motors will drive product upgrades; The demand in the field of smart grid has increased by 15% year-on-year, and higher standards have been proposed for the corona resistance of insulation materials for high-voltage equipment. The traditional motor and transformer fields are showing a trend of "stock upgrading", and the market share of high-temperature resistant enameled wire has reached 45%, gradually replacing ordinary products.

2. Technology side: Dual breakthroughs in green manufacturing and circular economy

Driven by environmental policies and the "dual carbon" target, the technological upgrading of the enameled wire industry is accelerating. Solvent free products have become the mainstream of green transformation. By 2024, the market share of solvent-free self-adhesive polyurethane enameled wire has reached 5%, doubling compared to 2021. This process can significantly reduce volatile organic compound emissions and reduce raw material costs by 12% -15%. Breakthroughs have been made in the recycling technology of scrap copper. Anhui Tongling Qisheng Metal has overcome the problem of controlling dioxins during the pyrolysis and melting process of waste enameled wire through the national key research and development project of "Deep Purification and Recycling of Copper and Aluminum Waste Materials in the High end Field", achieving a large-scale production of 20000 tons of electronic grade recycled copper materials per year, increasing the "primary recycling" rate of waste copper to 92%, and reducing carbon emissions by more than 60% compared to traditional smelting. As of 2024, the localization rate of special polyurethane resin has exceeded 85%, laying the foundation for independent and controllable industrial chain.

3. Market pattern: Record breaking exports and parallel optimization of production capacity

China has become a core hub for global production and export of enameled wire, with particularly impressive performance in 2024: the export volume of self-adhesive polyurethane enameled wire reached 80000 tons, a year-on-year increase of 22%; The export volume of enameled copper round wire was 156000 tons, a year-on-year increase of 8.7%; The year-on-year increase in exports of all categories of enameled wire from January to October was as high as 30.01%. The export market presents a "bipolar driven" feature: Southeast Asia accounts for over 40%, and manufacturing destinations such as Vietnam and Thailand have strong demand for price sensitive products; The European market focuses on high-end performance, and environmental certification has become a key entry threshold. The domestic market presents a pattern of "head concentration and capacity optimization". The three leading enterprises, AVIC Optoelectronics, Baosheng Corporation, and Far East Corporation, collectively hold over 60% of the market share, consolidating their advantages through technological upgrades and capacity expansion. However, the industry as a whole is facing overcapacity pressure. By 2024, the industry's production capacity will exceed 3.74 million tons, with a demand of about 2.4 million tons and a capacity utilization rate of only 64%. The intensification of "internal competition" in mid to low end products is forcing small and medium-sized enterprises to transform towards differentiation and refinement.